Weight Loss Drugs: We Really Have Found the Silver Bullet!

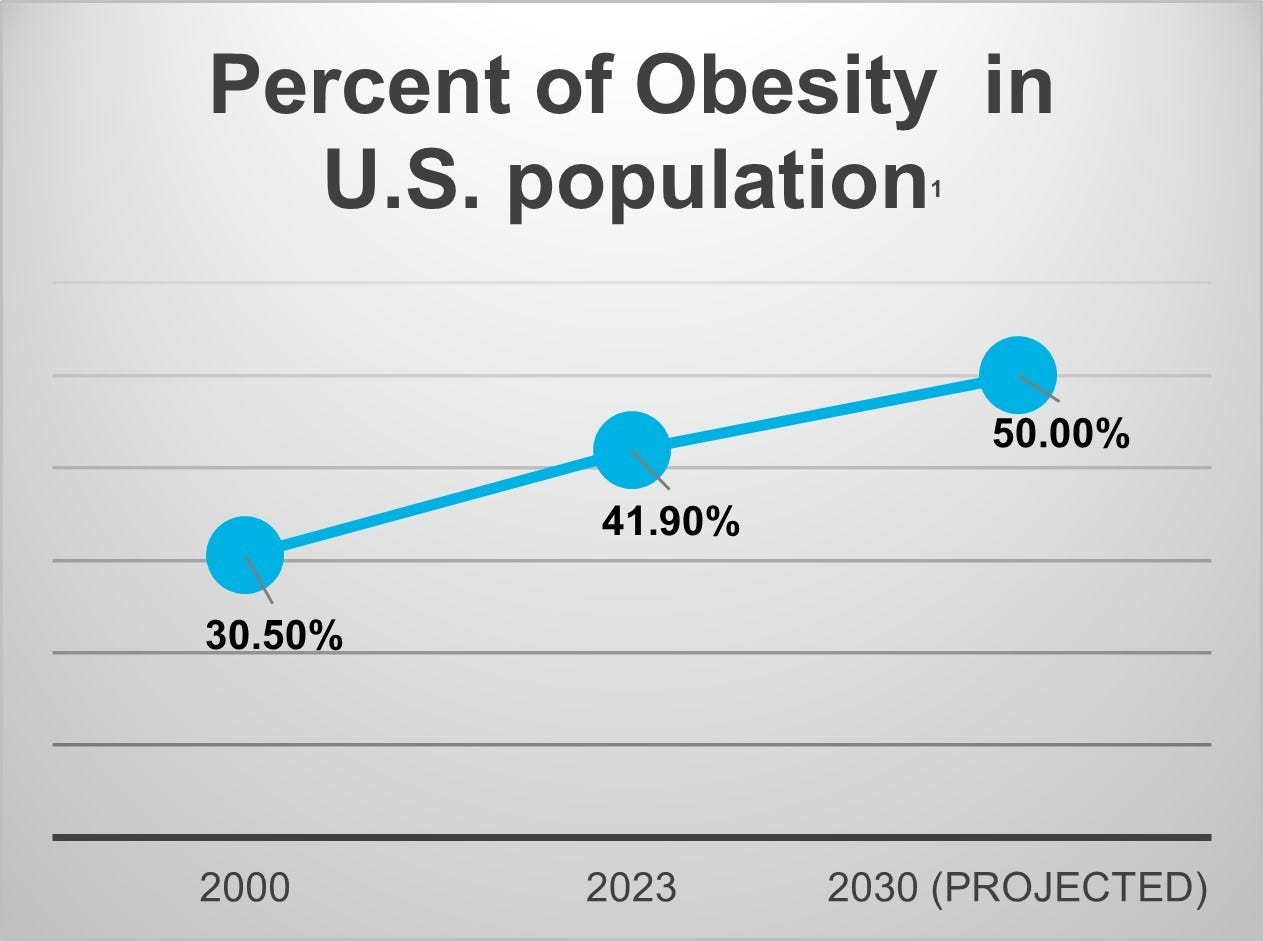

Washington, DC - Obesity has increased from 30% of the US population in 2000 to 42% in 2023. Projections show this increase will continue and reach 50% by 2030 [1]. A multi-billion-dollar weight loss and exercise industry has been developing for several decades, yet the obesity rate continues to increase and been linked to $1.4 trillion in annual costs![8]

Earlier last year, we saw headlines of a weight loss treatment that safely and effectively decreased body weight. Indeed, a silver bullet for weight loss has been discovered!

Types of weight loss drugs

Since 1959, weight loss pills have been available in the form of anorexiants. Today, these treatments are available by the brand names Tenuate, Lomaira, with active ingredients phentermine, Ionamin, and others. This treatment acts on the brain to suppress appetite. Studies have shown that anorexiants can decrease body weight by 5-7%.

In 2014, the first GLP-1 (Glucagon-like peptide -1 receptor agonist) was released in the form of liraglutude, and in 2021 in the form of semaglutide. The difference in the mechanism of the GLP-1 is that it works by mimicking a hormone produced by the gut called GLP-1. This is the hormone that promotes fullness & satiety. These medications help lower blood sugar by helping the pancreas make more insulin. It also slows digestion by increasing the time it takes for food to leave the body. Originally developed for the treatment of type II diabetes, Novo Nordisk was the first manufacturer that received FDA approval to use the drug for weight loss as branded Wegovy. In November 2023, Eli Lilly received approval for its weight version called Zepbound.

The GLP-1 medications have been shown to decrease body weight by up to 20% in some studies [9], significantly outperforming anorexia drugs.

Price Matters

The positive impacts of the silver bullet are real, but unfortunately, the price tag is high. So high that most insurance companies will not cover it for weight loss (but continue to cover the version designed for type II Diabetes). The average manufacturer’s monthly cost for GLP-1 is $1,100, which is the cash price. Anorexiants, by contrast, average around $90. There seems to be some different lines of thought along how long patients should be on the GLP-1.

According to a recent study, "Findings confirm the chronicity of obesity and suggest ongoing treatment is required to maintain improvements in weight and health [10]."

On the other hand, many clinicians are using the treatment as a temporary regimen, designed to achieve a lower weight that can be maintained by new eating habits developed during the medication period. Since the treatments are so new, we do not have conclusive information on the necessity of long-term use.

Some employer organizations like the Mayo Clinic are starting to put a lifetime cap on GLP-1 [21] – seemingly going against the only research published on the topic. We have also seen some payers ease preauthorization requirements for bariatric surgeries. Although payers deny the tactic as a response to GLP-it has been observed that bariatric surgery costs upwards of $26,000 compared to the annual $11k for the medication, making bariatric surgery less expensive for payers in the long run.

Suggestions for Decision Makers

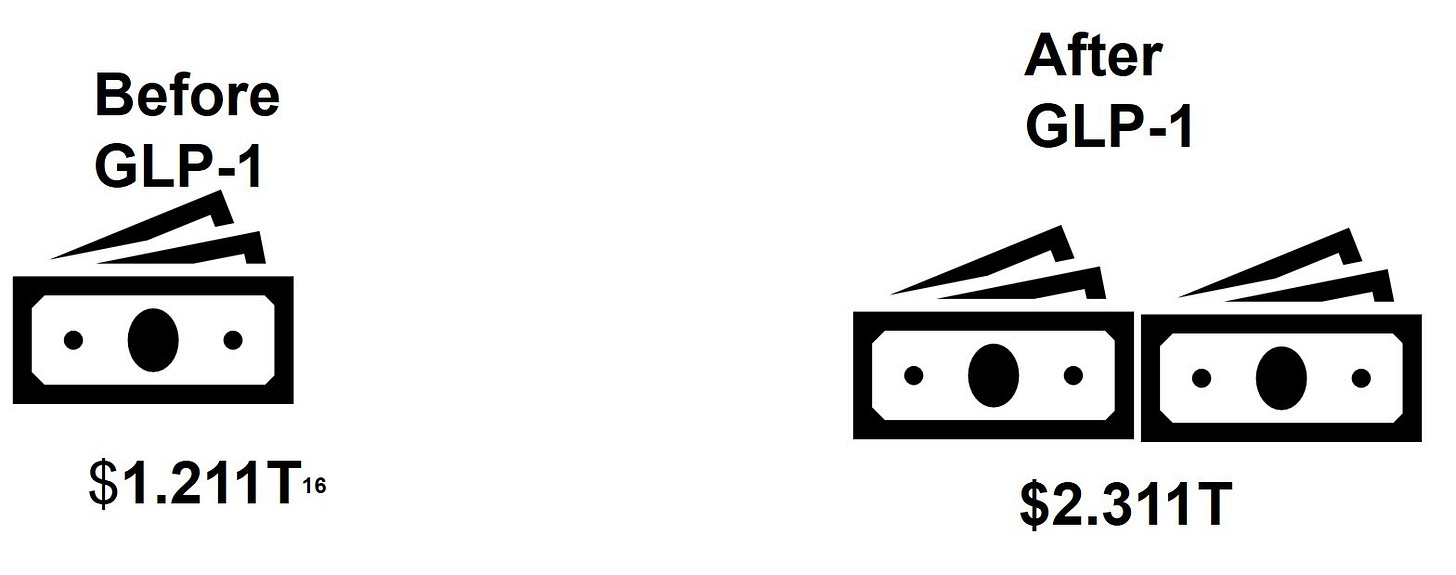

My financial analysis demonstrates that prescribing GLP-1 to all obese patients does not provide an adequate return on investment. Even with the 20% decreases in body weight and the research that shows a reduction in body weight of 5-10% significantly lowering chronic disease incidence [8], the numbers just don’t work out. The US commercial healthcare population spends $1.1T [16] on healthcare annually. If all people with obesity were to take GLP-1 drugs, the annual healthcare costs would DOUBLE!

Receive Health Trends direct to your inbox

In light of these challenges, here are some recommendations:

Be patient.

Although the high cost of Wegovy is unsustainable now, the more competitors entering the markets, the sooner the price will drop. In addition to competition, an investigative article in the New York Times [13] discovered that health insurance companies are paying 80% to as low as 50% of the actual manufacturer/cash prices indicating the price is not as high as we once thought, leaving opportunities for negotiations on the manufactures price.

2. Better define the ideal candidate

Although 40% of Americans are obese, that doesn’t mean everyone will benefit from the drugs equally. Partnering with clinical research can better help payers and employers set parameters on authorization beyond a BMI score. Just as bariatric surgery candidates need to try diet and exercise, paired with nutrition assessment/counseling prior to surgery, similar restrictions can be made for GLP-1 users, to make ensure the right patients are receiving the medication.

3. Know your competition

By now, we know that not only are medical weight loss clinics popping up on every corner, but virtual weight loss clinics are just as common. This increased access is making the medication available easily and online. Many of these businesses are selling the medication along with medical management for less than $500 per month. Often these drugs are processed through a compounding pharmacy which creates a non-branded version of semaglutide. These compounds are not FDA approved and could have possible safety or efficacy concerns but are being sold at a significant discount to the customer as a cash price.

The Medical cost trend (inflation) increases due to utilization, waste, and duplication of service but also due to improved technology and better treatments. GLP-1 drugs will have a huge impact on the diseases most influenced by obesity such as low back pain, heart disease and diabetes. At this point in time, the healthcare ecosystem needs to spend as much resource, time and energy figuring out how to make the weight loss drugs financially viable to maximize the life-changing silver bullet!

Josh Hollander advises provider groups, hospitals, and healthcare tech organizations navigate the complex healthcare environment. With over 20 years of experience, Josh helps client’s increase and stabilize revenue by developing and implementing innovative payment models, supporting managed care contracting, launching provider engagement initiatives, and navigating regulatory compliance and policy changes. Additionally, Josh speaks to national audiences at trade conferences, association meetings and is an adjunct faculty member WITS, in Baltimore, Maryland where he teaches economics, business management and “Healthcare in America”.

2 https://www.census.gov/library/publications/2023/demo/p60-281.html

3 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9486455/

4 https://www.nejm.org/doi/full/10.1056/NEJMoa2032183

5 https://www.nejm.org/doi/full/10.1056/NEJMoa2206038

6 https://obesitymedicine.org/blog/weight-loss-medications/

8 https://milkeninstitute.org/report/weighing-down-america-health-and-economic-impact-obesity

10 https://dom-pubs.onlinelibrary.wiley.com/doi/10.1111/dom.14725

11 https://www.drugs.com/medical-answers/long-lose-weight-wegovy-3570091/#Key%20Points